stock option tax calculator canada

Type of Option ISONSO Strike Price. During the vesting period you can pay ordinary income tax on the restricted stock award or buy your shares and pay long-term capital gains taxes.

Land Transfer Tax Calculator A Strong Option To Get Home With Land Transfer Tax Basic Facts Life Facts Home Equity Loan

Deduct CPP contributions and income tax.

. When determining the amount of the security option benefit subject to income tax withholding we will permit the employer to reduce the benefit by 50 using the Security options deduction under paragraph 110 1 d. Exercising your non-qualified stock options triggers a tax. Build Your Future With a Firm that has 85 Years of Investment Experience.

This calculator illustrates the tax benefits of exercising your stock options before IPO. Enter the commission fees for buying and selling stocks. The employees benefit inclusion is 20 10 10.

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. If you have any questions on how to calculate the alternative. Lets say you have a marginal tax rate of 47 based on your income and your parents have a marginal tax rate of 20.

Security options deductions. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. Ad This dynamic tool forecasts the expected range of the SP 500 Index over the next 30 days.

So if you have 100 shares youll spend 2000 but receive a value of 3000. Select Province and enter your Capital Gains. An option is an opportunity to buy securities at a certain price.

The Stock Calculator is very simple to use. All federal and provincial taxes and surtaxes are taken into account however the calculator assumes that only the basic personal tax credit as well as the dividend tax credit and Canada employment amount if applicable are available. If you decide to exercise your option and buy the securities at less than the fair market value FMV you will have a taxable benefit received through employment.

1 received royal assentBill C-30 enacts the new rules for the taxation of employee stock options that had been announced in the federal governments November 30 2020 Fall Economic Statement. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. Tax rates for you.

You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income. 409A Value of Shares at Exercise. Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share.

If you both make 20000 in investment income for 2021 youll pay different taxes on stocks in Canada outlined in the table below. On June 29 2021 Federal Bill C-30 Budget Implementation Act 2021 No. Type of investment income.

Use this calculator to determine the value of your stock options for the next one to twenty-five years. One-half of the amount taxable - 110 1 d 120000 shares less the 20000 non-qualified shares 100000 shares eligible for the deduction 100000 shares x 3 - 2 x 50 50000. Report a problem or mistake on this page.

Enter the purchase price per share the selling price per share. The securities under the option agreement may be shares of a corporation or units of a mutual fund trust. Box 14 may include other income.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. The taxable benefit is the difference between the fair market value FMV of the shares or units when the employee acquired them and the amount paid or to be paid for them including. How Are Restricted Shares Taxed.

Use the simple annual Capital Gains Tax Calculator or complete a comprehensive income. Cost of Capital of shares Value per Share at Exit. The capital gains tax rate in Ontario for the highest income bracket is 2676.

Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional. How much are your stock options worth. That means youve made 10 per share.

Taxes for Non-Qualified Stock Options. The calculator will show your tax savings based on the specified RRSP contribution amount. For example the option price is 10 for 15 shares and the employee exercised the option when 15 shares were worth 20.

This permalink creates a unique url for this online calculator with your saved information. Just follow the 5 easy steps below. If shares are valued at 20 at that time the stock is worth 20000.

Ad Calculate the impact of dividend growth and reinvestment. Amount to be included on the T4. Please enter your option information below to see your potential savings.

Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. Subsection 110 1 of the Income Tax Act allows the employee to report only half of the benefit derived from exercising the employee stock option. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. You will only need to pay the greater of either your Federal Income Tax or your AMT Tax Owed so try to be as detailed and accurate as possible. Even after a few years of moderate growth stock options can produce a handsome return.

For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit. Enter the number of shares purchased.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

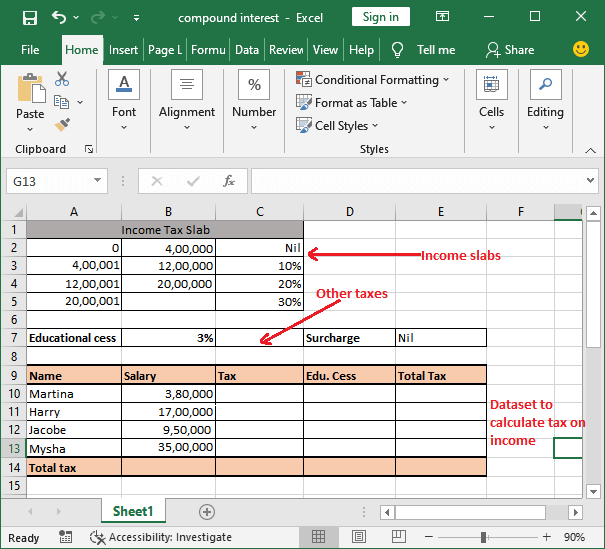

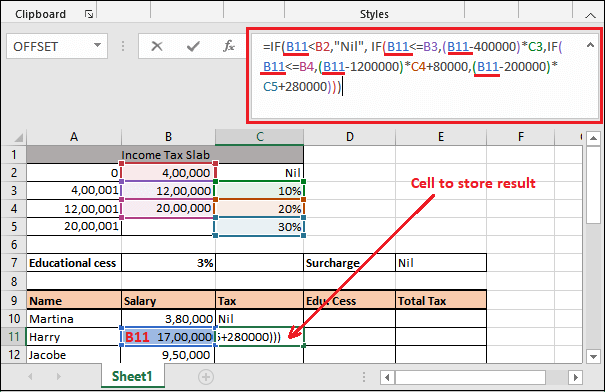

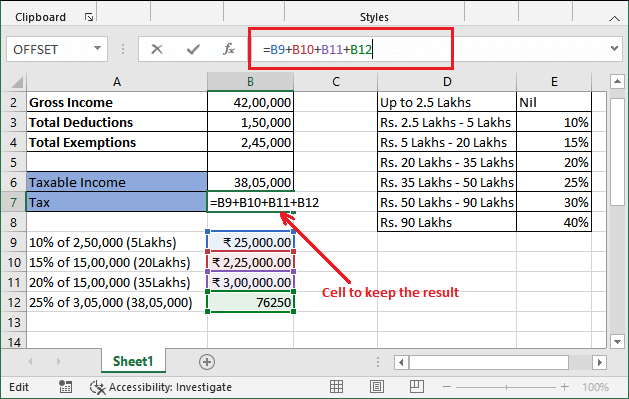

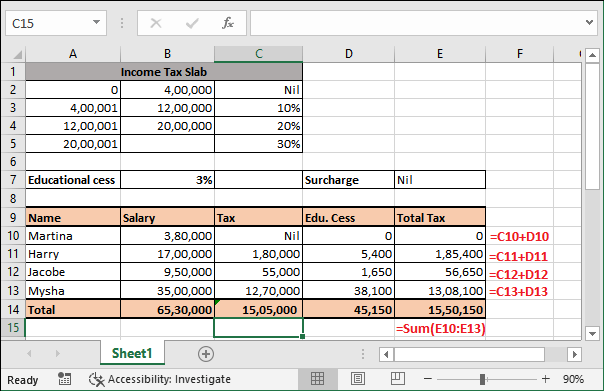

Income Tax Calculating Formula In Excel Javatpoint

Restricted Stock Units Jane Financial

Capital Gains Tax Cgt Calculator For Australian Investors

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculating Formula In Excel Javatpoint

Capital Gains Tax Calculator 2022 Casaplorer

Income Tax Calculating Formula In Excel Javatpoint

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

How Fees Can Lower Your Income Tax Koinly

How To Calculate Pre Tax Profit With Net Income And Tax Rate The Motley Fool

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property

Income Tax Calculating Formula In Excel Javatpoint

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How Is Taxable Income Calculated How To Calculate Tax Liability